COVID-19 is proving to be an economic crisis almost as much as it is a public health crisis. Stock markets remain volatile, millions are filing for unemployment, and millions more fear for their economic futures. As state, local, and federal governments extend stay-at-home guidelines, it’s unclear when things will get “back to normal.” That’s why it is more important than ever to look at your consumer insights through a financial lens that reflects the fluctuations in their ability to purchase goods and services and overall financial confidence.

How Concerned Are Consumers about Their Finances?

According to a Pew Research Center study conducted March 19-24, 2020, one-in-six Americans anticipates an economic depression, and another half anticipate a recession as a result of coronavirus. In this study, 43% of lower income respondents indicate someone in their household has lost a job or taken a pay cut due to the pandemic; young people are especially likely to be in this situation.

Data provider Dynata graciously granted us access to responses from over 15,000 consumers across 14 countries collected March 17-19 for their COVID-19 Global Trends Report Special Edition. Based on this information, we can draw some conclusions about how consumers’ economic anxieties stack up across the globe:

- Consumers have financial concerns. Over half of adults in Spain were very or extremely concerned about their household’s financial position (56%), outpacing Italy (41%) and the U.S. (34%). While concern was numerically highest in India – even though the country was not yet locked down at the time of the study – this figure (57%) is likely attributable to that country’s notorious high rater bias, which tends to inflate all India scores relative to other countries.

- They’re influenced by the indicators. Every country except China had many more people concerned about the financial markets than were concerned about their own household’s financial position (+13 points, on average) or their own employment (+22 points). But the relationship between concern for one’s own household financial position and concern about the financial markets was quite strong in the U.S. (correlation of .48) and Japan (.39), while being much weaker elsewhere (.10 – .29).

- They are not convinced they should “take one for the team.” Among those “extremely or very worried” about their household financial position, 49% in hard-hit Italy and Spain “agree strongly” that “we must think of the common good first, and put our own needs second.” This compares with the U.S. where only 40% of those worried about their own finances (and 25% of those not very worried) express the same sense of altruism.

- They are spending cautiously. Even among Americans not very worried about their household’s financial position, 19% had already “decided not to make a non-essential purchase” and 36% said they were “considering only making essential purchases.” These figures climb to 34% and 45%, respectively, among those very worried about their finances.

Relationship between COVID-19 Impact and Prior Financial Position

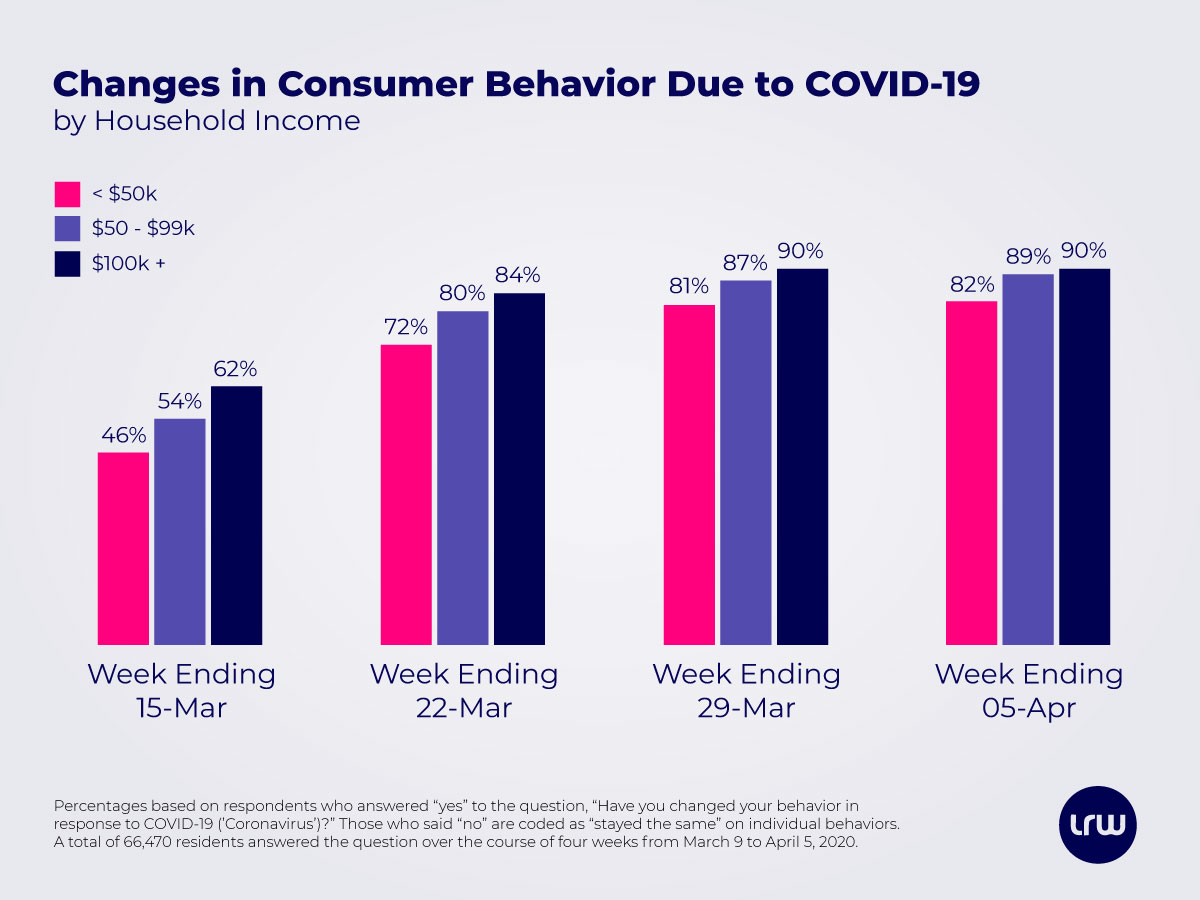

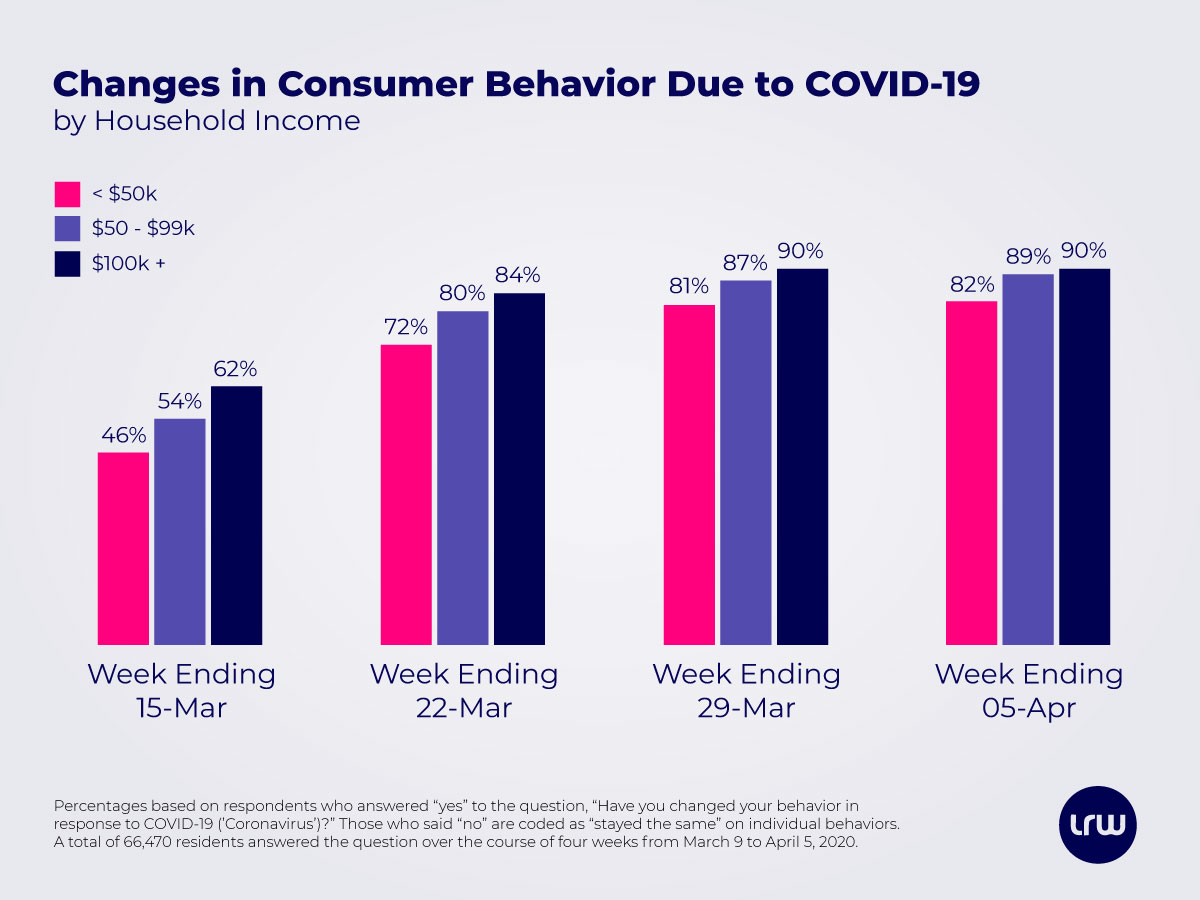

Turning to LRW’s ongoing tracking data, we found last week that 87% of American consumers changed their behaviors in response to the pandemic, with lower income Americans nearly catching up to their higher income counterparts.

Why did households with higher incomes react sooner? Was it their ability to work from home, to pay closer attention to news reports, or simply the fact that they live in areas of the country most disrupted by the virus? It is likely all of these factors to one degree or another.

Ultimately, slower reaction is likely the impact of coronavirus on a person’s income (whether that baseline income was high or low), which is most likely to trigger behavior change. Between March 23 and April 5, 2020, three-in-ten Americans in each of the income levels above reported that they had “stopped entirely” buying “nonessentials (toys, games, clothes, etc).” But this belt-tightening varies quite a bit based on the impact that coronavirus has had on the household’s income:

- 42% among the 14% who report “our income has halted and we have nothing to fall back on“

- 35% among the 36% with some remaining income or at least 3 months’ savings

- 26% among the 50% whose incomes to-date have “stayed roughly the same” or “increased” — with no statistically significant differences across income levels.

How Should Researchers Think about Income?

Based on these critical early insights, LRW offers the following guidance for researchers as they measure consumer attitudes and behaviors in light of the financial impact of this crisis:

- Use last year’s income to ensure sample representativeness. With employment levels and compensation in flux, asking respondents “your current household income” is unreliable and potentially heartless, generating anxiety and confusion. We believe that last year’s household income is the only appropriate metric for sampling and/or weighting, to ensure a representative sample.

- Use impact on income for analysis. Since actual income, savings and consumer confidence are strong predictors of discretionary spending, we recommend a separate question about the impact of the pandemic on the respondents’ financial situation as an important lens for analyzing your data. Place this question at the very end of the survey, due to the potential for break-offs or negative emotions that could color your results.

- Don’t look only at “income” and think you understand what’s going on. Combine 2019 income, the coronavirus’ impact on income, personal concerns, and likely cost-of-living or household size when interpreting consumers’ ability to spend or likelihood to buy.

Finally, as this health and economic crisis evolves, insights professionals will likely need to switch the lens they use to interpret their data more than once in order to make sense out of what is going on. As the coronavirus rolls in waves throughout the country, impacting the lives in different regions and industries at different times, you need to be agile enough to pivot your analyses and dig deeper below the surface of your numbers.