It’s hard for marketers to make sense of all the information coming their way about the consumer impact of COVID-19. For every news story suggesting that everyone is hunkering down in bunkers with rooms full of toilet paper and hand sanitizer, there’s another that shows people frolicking in groups on the beaches. So what’s going on? Are consumers reacting or not?

The not-so-straightforward answer: some are and some are not.

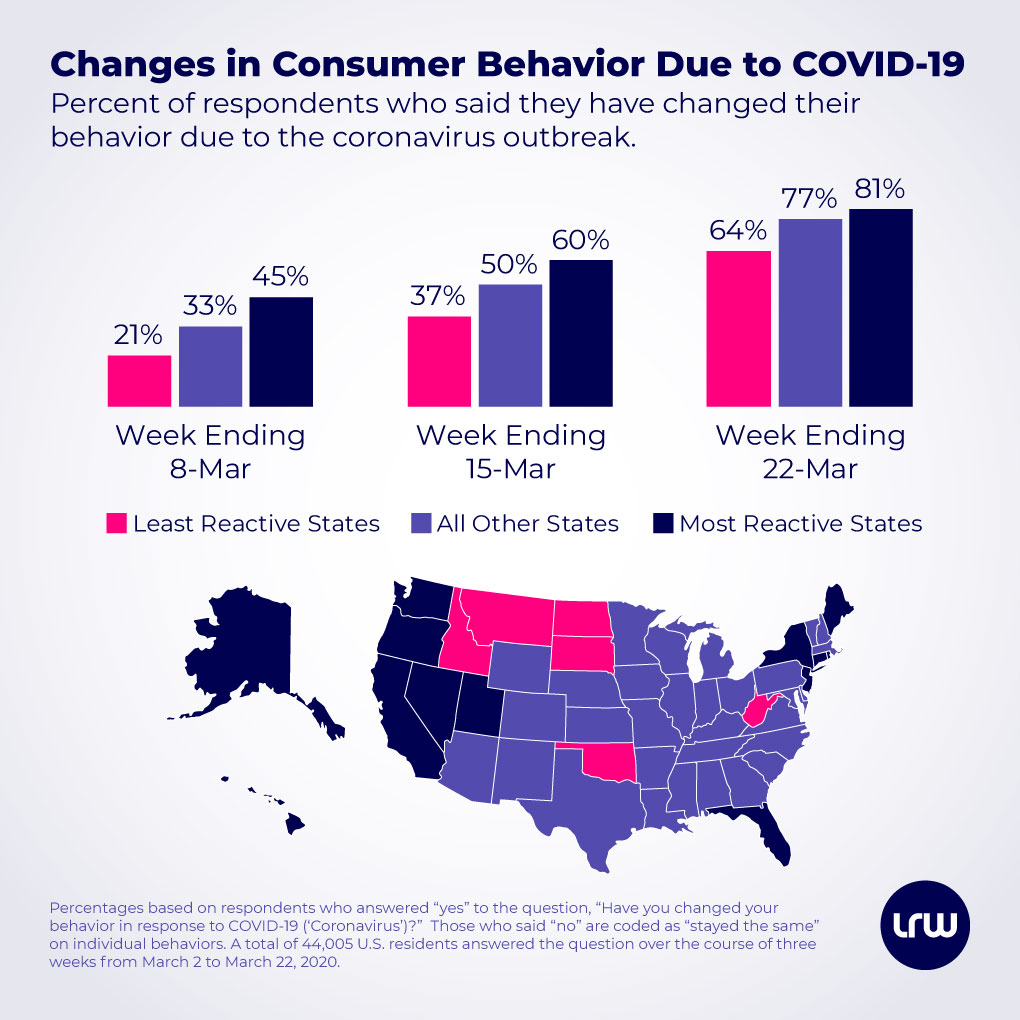

When it became apparent that the coronavirus outbreak was likely to be an economic event, and not just a public health event, LRW started adding behavioral impact questions into all of our brand trackers so we could keep a pulse on consumer reactions to the situation, and use it to help analyze our category-specific results. Here are some key findings gleaned over the past three weeks (through March 22, 2020) from 44,005 respondents to dozens of trackers in the U.S.

Our data also reinforces that there is a significant lack of a consistent nationwide response. States with fewer confirmed cases and laxer guidelines have dramatically lower levels of consumer response.

Consumer activities likely remain strong in those least reactive states because they may not have “gotten the memo” yet that they are not immune to this virus. Just as Europe lagged China, and New York lagged Italy, so presumably will these more isolated states lag New York (especially if so many residents there continue to go about their daily lives as if this is a “hoax”). Those in the Heartland may want to study the “lockdown” states so that they can protect their residents now by waking them up to what’s coming.

EDITOR’S NOTE 3/31/20: As cases have spread to more states, the differences in reactivity have softened. In the week ending March 29, the proportion of respondents who have changed their behavior jumped up to 79% in the least reactive states, nearly as high as the moderate and most reactive states (85% and 86%, respectively).

You must be logged in to post a comment.