Posted On February 15, 2019

We all know how Super Bowl ads generate lots of conversation at the water cooler and on social media. For brands, a brief spike in social media interest can be exciting, but those moments can also be fleeting and don’t necessarily translate into either sustained interest or a shift of conversation to the brand or product’s benefits.

Brands can, however, get a much richer look at their ads’ overall impact if they analyze how they’re discussed in online communities (i.e. forums, message boards, blog comments and review sites) where many of their most passionate advocates (and detractors) express themselves. Our ace team at LRWMotiveQuest (MQ) conducted a comprehensive online anthropology study of how these brands resonated across 9 million total conversations within these online communities over the course of a full week after the big game. Based on this analysis, here are five brands that enjoyed the most notable sustained interest in the seven days after Super Bowl LIII:

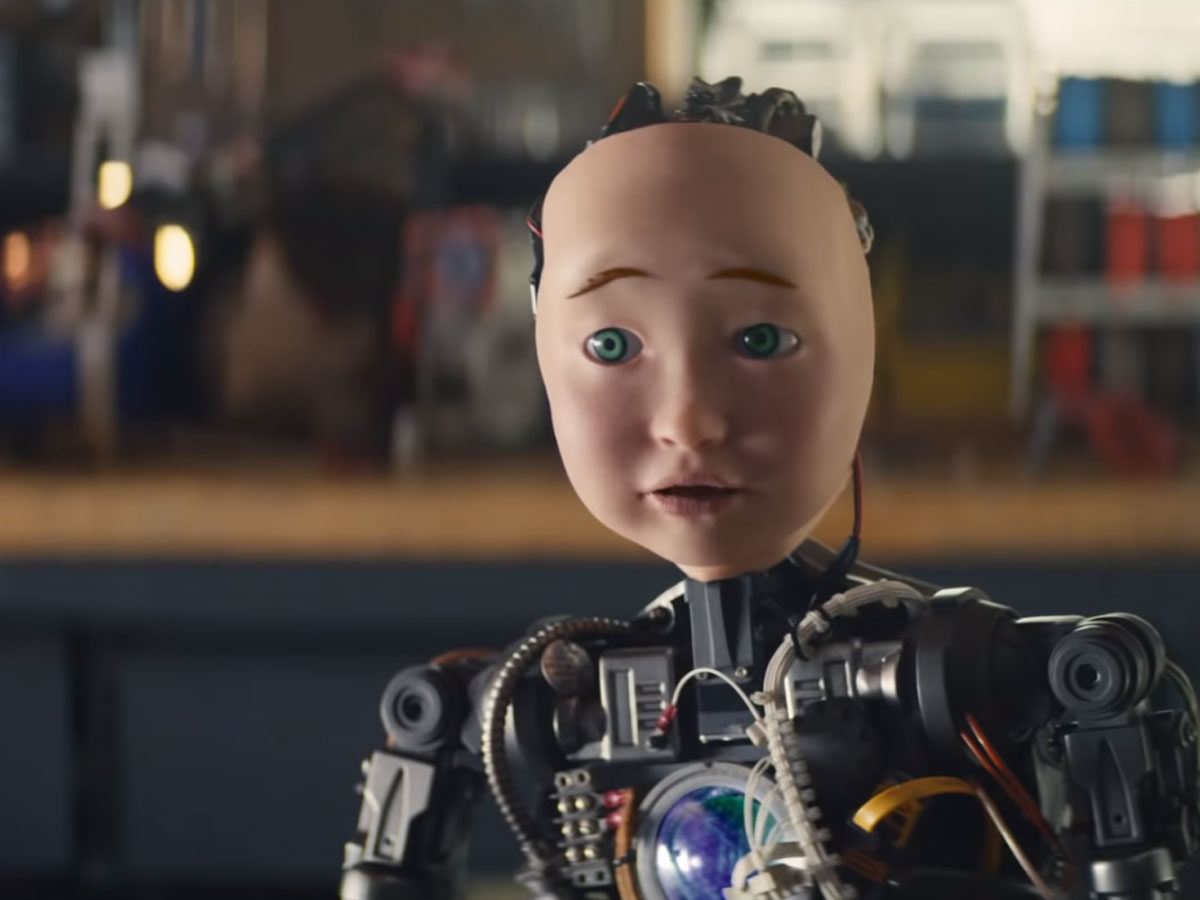

- TurboTax: The #RoboChild ad was labeled creepy in social media circles, but it seems to have done its job by building awareness for Turbo Tax at a critical time when Americans are gearing up for tax season. The ad itself was discussed very little on communities and forums, and instead Turbo Tax was discussed at rates higher than before the big game as a recommended product to file taxes.

- Persil ProClean: It’s great when your expensive ad is discussed online, but it’s even better when people are just discussing the product itself. MQ strategists found that conversation surrounding the laundry detergent brand increased, even though only about 1/8 of conversations were about the Super Bowl ad. MQ suspects that nonconscious awareness inspired by the ad helped this overall boost.

- Bubly: Similar to Persil, conversation surrounding this sparkling water brand bubbled up as the week went on, with fewer than a quarter of the brand’s conversations focused on the ad. That’s a surprising and encouraging statistic for a brand that many people never heard about before the Super Bowl. As a point of comparison, 74% of all online conversations about Avocados from Mexico were strictly about its ad.

- Anheuser-Busch: Though not overtly mentioned in ads, conversation about the master brand Anheuser-Busch increased over the course of the week post game. Bud Light’s immediate spike dwindled quickly, while Budweiser decreased more slowly. But robust conversation stayed strong and steady for Anheuser-Busch around wind power, corn syrup and whether the company did – or did not – take a political stand. When a brand is attacked, its advocates come to the defense and MQ sees that happening for Anheuser-Busch.

- Bumble: The emerging dating app saw a sustained afterglow in the days after the big game. Moreover, almost all of the brand’s online conversation is about the app, how it works, and how it compares to other dating apps. You can be sure Bumble is happy to “swipe right” on that sort of brand engagement.

LRWMotiveQuest’s Super Bowl LIII brand study is based on an analysis of 9 million conversations by over 2 million people, across publicly available online communities. MQ analyzes consumer conversations in the context of business issues and goals, going beyond simply describing what people are saying to understanding why they behave the ways that they do. More details on LRWMotiveQuest can be found here.