The nearly $900 billion restaurant industry has been reeling, experiencing a 74% decrease in seated diners due to coronavirus closures, social distancing restrictions, and general fear of contracting or spreading the virus. As a result, over 8 million U.S. restaurant workers had lost their jobs by mid-April, causing ripple effects through the rest of the economy.

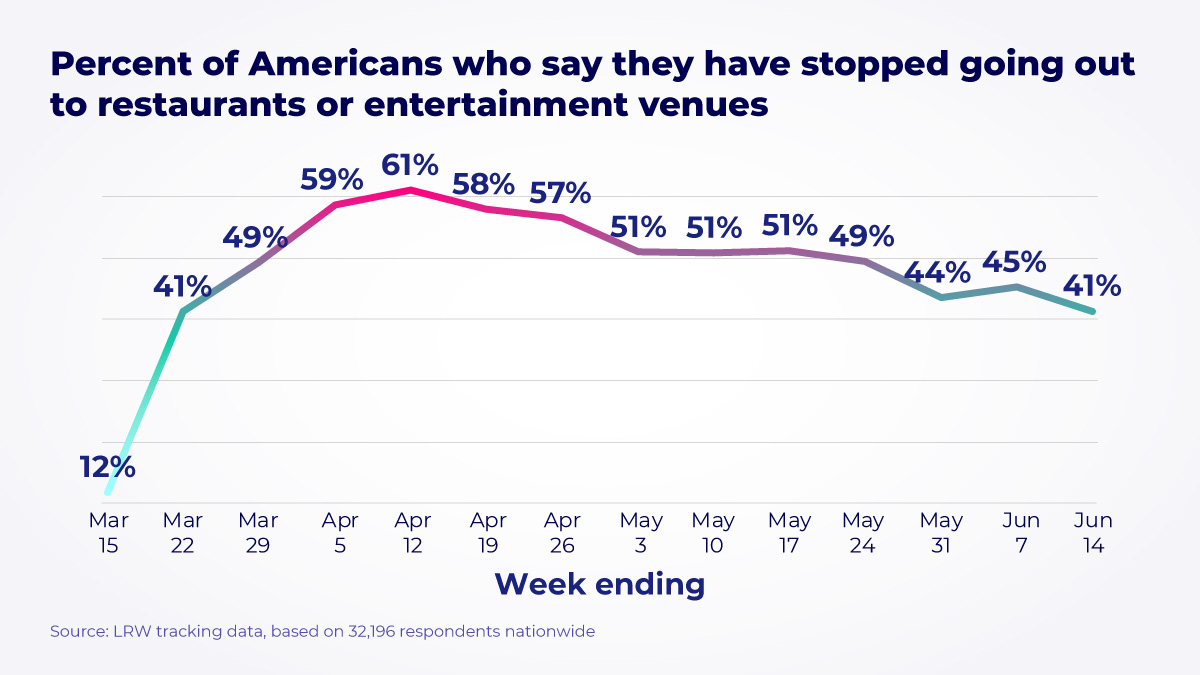

At the height of closures and concern in April, LRW’s ongoing tracking found that 61% of Americans had “stopped entirely” going to restaurants or entertainment venues. That number has steadily but gradually declined to 41% today. At this rate, the recovery of dine-in could take many more months. But while visitation rates have not fully rebounded, millions of American have started heading out to restaurants (if they can find one open), motivated by quarantine fatigue or a desire to support local businesses and bolster the economy.

Depending on what state you survey, the likelihood that someone in the past month would report having “stopped entirely” going to restaurants or entertainment venues varies from a high of 59% in Rhode Island to a low of 33% in Utah.

While they are in varying stages of opening, the majority of residents in the nine Northeast states surrounding and near the coronavirus epicenter of New York City are not going out to restaurants at all. In contrast, the majority living in each of the eight Mountain states, as well as the eleven West Central states, have resumed at least some nightlife behavior.

But beyond this loose epicenter-or-not type of grouping, it is difficult to detect a simple rhyme or reason for the dramatic differences by state. Since the market doesn’t seem to be tying its behavior to past or predicted spread, local ordinances are more relevant indicators. But the rules vary by county within larger states and no easy reference is available (try OpenTable for one source).

While there is strong regional variation on America’s reopening, there is also wild variation in how willing Americans within any given geography are to return to restaurants and other entertainment venues.

Referring to LRW’s Coronavirus Coping Cohorts segmentation developed using InnovateMR’s COVID-19 tracking data:

Earlier this month, the WHO updated its guidance to recommend wearing masks in public, but consumers have been divided on the appropriateness of mask-wearing mandates and they’re confused by changing policies and mixed messages about the benefit of wearing masks. Some locales have ordinances requiring masks inside restaurants when not eating, while others leave it up to the discretion of the venue.

Depending on who you ask, mask requirements may or may not make patrons physically and psychologically more comfortable. According to the latest wave of COVID-19 tracking from our sister company Kelton Global, 49% of those over 73 years old who are open to dining in at a restaurant would be comfortable if “patrons are required to wear face masks when they’re not eating.” This rule is less popular with Boomers (31%) and younger generations (26%). Given these results, a restaurant owner or manager in an area of decreasing cases may want to consider only requiring masks in some sections of the restaurant or during senior discount hours, and relying more broadly on other mechanisms for reducing the risk of spread (e.g., contactless menus and payment methods).

Given the polarized feelings that many people still feel about dining out, restaurant marketers may feel like they’re in a no-win situation. But there are a few strategies they may want to consider instead of sitting on the sidelines:

How else can the marketing and research community understand and meet the needs of consumers in the COVID-19 Era? Visit LRW’s Coronavirus Resource Library to learn more.

You must be logged in to post a comment.