It’s been quite a while since “15 Days to Slow the Spread” united the country in what we all hoped would be a short-term effort to overcome a once-in-a-generation threat. In the last half of March 2020, three-quarters of respondents to tracking studies conducted by LRW, a Material Company, thought that they would be back to their “typical behavior and activities” within three months.

Nearly a year later, we’re still dealing with the new normal caused by the fear of a deadly pathogen and the economic havoc that has been wrought by trying to avoid catching and spreading it. The figures have now flipped. Three-quarters of our respondents in early December predicted it will be more than three months before things get back to normal, despite the start of vaccine distribution.

As with nearly everything else in life, the market is segmented on the issue of COVID-19, resulting in a wide diversity in how we are dealing with the pandemic. Some people have hardly left their homes in months (with or without strict stay-at-home orders) while others attended house parties in the Hamptons. Some people are lining up at food banks while others are driving the stock market to new highs by investing their freed-up fun money or hiring plastic surgeons as they have become disenchanted with how they look on Zoom.

Differences in coronavirus coping behaviors are not just driven by one’s age, employment, or disposable income, however. There are fundamental differences in what Americans believe about the pandemic, the risks it poses to them and to others, and what they themselves should do about it.

In the early days of the pandemic, we partnered with InnovateMR to measure Americans’ pandemic-related views and behaviors. At that time we created a simple segmentation that identified four broad groups based on how they feel about coronavirus:

The Extremely Anxious cohort skews young, female, urban, Hispanic, and Democrat. Deeply distressed emotionally, they find it difficult to distance themselves from coronavirus concerns. They’ve been hit hard financially by the pandemic, putting a deeper dent into wallets that were already stretched thin. Their category behaviors have been heavily disrupted and they have the longest time horizon for returning to normal.

The Extremely Anxious cohort skews young, female, urban, Hispanic, and Democrat. Deeply distressed emotionally, they find it difficult to distance themselves from coronavirus concerns. They’ve been hit hard financially by the pandemic, putting a deeper dent into wallets that were already stretched thin. Their category behaviors have been heavily disrupted and they have the longest time horizon for returning to normal.

As if lost jobs and reduced incomes aren’t enough to worry about, this group is also very concerned about the health of friends, family, and themselves. Only half think they are likely to remain healthy, likely since many are not able to socially distance and most have a comorbidity that puts them at increased risk for a bad outcome. They are less likely to be insured or to have confidence in the healthcare system and available screenings.

They’re likely to stock up on hand sanitizer and affordable PPE, seek out debt relief or credit consolidation services, frequent discount retailers and learn new skills at home and online. They respond to brand messaging that is reassuring or supporting and avoids scare tactics.

Safety Seekers take COVID-19 very seriously, and are cautious with their money, but they’re not overwhelmed by fear of the virus or the financial fallout. They’re anxious about the health of friends and family but confident in the healthcare system’s ability to handle this, so long as others join them in fighting the good fight through wearing masks and social distancing. When the country first began reopening, half felt it was happening too soon.

Safety Seekers take COVID-19 very seriously, and are cautious with their money, but they’re not overwhelmed by fear of the virus or the financial fallout. They’re anxious about the health of friends and family but confident in the healthcare system’s ability to handle this, so long as others join them in fighting the good fight through wearing masks and social distancing. When the country first began reopening, half felt it was happening too soon.

Safety Seekers immerse themselves in coronavirus news coverage (typically from left-leaning sources) and reject the idea that the country is over-reacting. Proactively taking steps to protect themselves, they are likely to seek out immunity boosting items, home exercise classes or equipment, cleaning products, and fashionable facial coverings. They respond well to messages that emphasize the steps brands are taking to protect their safety, and that of the public.

Insulated Altruists respect, but don’t fear, the virus and its economic consequences. Likely to be working from home, the vast majority expect they’ll personally remain well and are confident the healthcare system can take care of them if they don’t. Although they skew somewhat older, they under-index on comorbidity risk factors, so fewer are afraid when they leave the house.

Insulated Altruists respect, but don’t fear, the virus and its economic consequences. Likely to be working from home, the vast majority expect they’ll personally remain well and are confident the healthcare system can take care of them if they don’t. Although they skew somewhat older, they under-index on comorbidity risk factors, so fewer are afraid when they leave the house.

Insulated Altruists entered this crisis with higher incomes and have largely been unaffected by job losses or pay cuts. They expect this good fortune to continue so they report that they are helping others rather than focusing on scraping by themselves.

Insulated Altruists seek out home enhancement products or projects to pass the time or make their new offices more comfortable. They’re also using this time to focus on their stock portfolio and are more charitable now than ever. They satisfy their need for exploration by indulging in quality restaurants in their areas – even if it’s just for takeout and delivery. They respond well to social responsibility messages about what brands are doing to support essential workers and the needy during “these unprecedented times.”

The Unconvinced segment is largely ignoring the crisis, avoiding coronavirus news, and criticizing what they hear. They expect that they and their loved ones will remain well, think the country has been overreacting and don’t think social distancing is important. They think businesses and society overall have been closed for too long, feel trapped or unduly restricted, resist masks, and would fervently resist any attempt to use surveillance technology to trace the virus. They have changed their behavior as little as possible, subject only to restrictions put in place by government authorities.

The Unconvinced segment is largely ignoring the crisis, avoiding coronavirus news, and criticizing what they hear. They expect that they and their loved ones will remain well, think the country has been overreacting and don’t think social distancing is important. They think businesses and society overall have been closed for too long, feel trapped or unduly restricted, resist masks, and would fervently resist any attempt to use surveillance technology to trace the virus. They have changed their behavior as little as possible, subject only to restrictions put in place by government authorities.

The Unconvinced jump at the chance to travel, visit bars and restaurants, or attend crowded events. They connect with messaging that is outgoing, individualistic, fun-loving, and perhaps a touch rebellious. This group skews young, male, and Republican.

Despite the wild swings of case counts and local restrictions associated with the waves that have swept the country, the sizes of these segments within the U.S. have remained remarkably stable over time. There is somewhat more size variation when comparing consumers of different product categories. Logically, The Unconvinced are more likely to be taking part in out-of-home activities, for example.

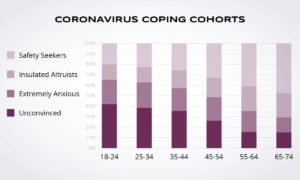

Unlike many other attitudinal segmentations, this one has relatively strong skews by age, likely due to the greater health risk to older Americans and the greater economic and social impact on younger ones. The majority of those age 55+ are Safety Seekers and Insulated Altruists while the majority of those under 35 are The Unconvinced or The Extremely Anxious, representing a powerful mindset split within young people.

Now that a vaccine is beginning to roll out, the U.S. administration has turned over, and there’s more of a light at the end of the COVID tunnel, will people’s views change enough that their segment assignments will shift? Or are these deeply held beliefs – set early in the pandemic and reinforced by the echo chambers that shape our daily lives – likely to stick with people for many months to come? These are the burning questions that policymakers and brands alike must answer in the coming weeks and months through smart and intensive market research.

Reach out to our team of Market Segmentation experts to learn more.

You must be logged in to post a comment.